44 a general co bond has an 8% coupon

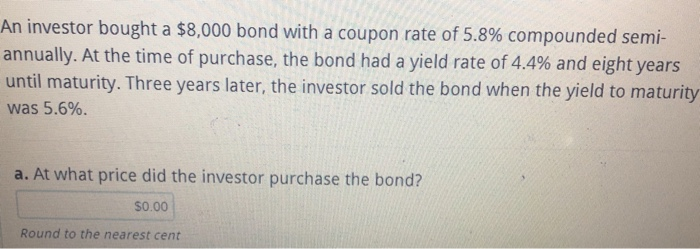

FIN 3000 HW 6 Flashcards - Quizlet Coupon rate = 8% A 2-year maturity bond with face value of $1,000 makes annual coupon payments of $80 and is selling at face value. What will be the rate of return on the bond if its yield to maturity at the end of the year is: a. 6% b. 8% c. 10% a. 9.89% b. 8.00% c. 6.18% You buy a bond for $980 that has a coupon rate of 8% and a 10-year maturity. CF Chp 8 Flashcards - Quizlet All else constant, a coupon bond that is selling at a premium, must have: A. a coupon rate that is equal to the yield to maturity. B. a market price that is less than par value. C. semi-annual interest payments. D. a yield to maturity that is less than the coupon rate. E. a coupon rate that is less than the yield to maturity

8 a general co bond has an 8 coupon and pays interest A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years.

A general co bond has an 8% coupon

An 8% semiannual coupon bond matures in 5 years. The bond has a... An 8% semiannual coupon bond matures in 5 years. The bond has a... Get more out of your subscription* Access to over 100 million course-specific study resources; 24/7 help from Expert Tutors on 140+ subjects; Full access to over 1 million Textbook Solutions; Subscribe Answered: ) A bond has a $11,000 face value, an… | bartleby Question. thumb_up 100%. 16.) A bond has a $11,000 face value, an 8-year maturity, and a 2.75% coupon. Find the total of the interest payments paid to the bondholder. A 12 year 5 coupon bond pays interest annually The bond has a face ... A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? A) 7.79% The bond sells at a premium, so its YTM has to be below 8%.

A general co bond has an 8% coupon. Coupon Bond Questions and Answers - Study.com An 8% annual coupon bond has three years until maturity. ... A General Electric 7\frac {1}{2} 25 bond closed at 98. ... You bought one of Great White Shark Repellant Co.'s 8 percent coupon bonds ... A General Co. bond has an 8% coupon and pays interest ... Answer to: A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,018.50. The... Solved 1a) A General Co. bond has an 8 percent coupon and - Chegg 1a) A General Co. bond has an 8 percent coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? 1b) You intend to purchase a 10-year, $1,000 face value bond that pays interest of $60 every 6 months (semiannual). Solved A General Co. bond has an 8% coupon and pays | Chegg.com A General Co. bond has an 8% coupon and pays interest semiannually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 7 years. What is the yield to maturity? A. 7.62% B. 7.79% C. 8.24% D. 8.12% Question: A General Co. bond has an 8% coupon and pays interest semiannually.

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment. A General Co. bond has an 8% coupon and pays interest ... A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity?... Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ... Buying a $1,000 Bond With a Coupon of 10% - Investopedia Conversely, if the bond price were to shoot up to $1,250, its yield would decrease to 8% ($100 / $1,250), but again, you would still receive the same $50 semi-annual coupon payments. This is...

Coupon Definition - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. Finance Chapter 5 Flashcards - Quizlet A 12-year, 5% coupon bond pays interest annually. The bond has a face value of $1,000. What is the change in the price of this bond if the market yield rises to 6% from the current yield of 4.5%? 12.38% decrease. The Lo Sun Corporation offers a 6% bond with a current market price of $875.05. FIN780 Chapter 5.docx - A bond with a 7% coupon that pays... If bond sells at par, the yield to maturity is the coupon rate. A General Co. bond has an 8% coupon and pays interest annually. The face value is $1000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? N = 20 PV = -1,020.50PMT = (1,000x8%) FV = 1,000 CPT I/Y = 7.79% A General Co. bond has an 8 % coupon and pays interest annually. 1)The Lone Star Co. has $1,000 par value bonds outstanding at 9% interest. The bonds will mature in 20yrs. Compute the current price of the bonds if the present yield to maturity is: (a) 6% (b) 8% (c) …

Answered: Assume that a company issued a bond… | bartleby Q: A firm's bonds have a maturity of 12 years with a $1,000 face value, have an 8% semi-annual coupon,… Q: What is the current price of a 4-year bond that has a face value of £100, a yield to maturity of 10%…

Solved A General Co. bond has an 8% coupon and pays interest ... A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? Expert Answer 92% (12 ratings) Yield to Maturity is the internal rate of return of the Bond. It represents the amount of profit or loss on the …

Coupon Bond - Investopedia Real-World Example of a Coupon Bond If an investor purchases a $1,000 ABC Company coupon bond and the coupon rate is 5%, the issuer provides the investor with a 5% interest every year. This means...

Solved A General Co. bond has an 8 % coupon and pays | Chegg.com A General Co. bond has an 8 % coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? Can I Question like this be solved by Hand, e.g. by extrapolation with a Discount table OR only by Trial and error and with a financial calculator?

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ...

Vanilla Ice Co bonds pay an annual coupon rate of 10 and have 12 years ... The coupon rate is 8% payable annually, and interest rates on new issues with the same degree of risk are 10%. Youwant to know how many more interest payments you will receive, but the party selling the bond cannot remember. If the par value is $1,000, how many interest payments remain? PV= 863.73 CPN PMT= 1000 X 8% = 80 FV= 1000 I/Y= 10% PMTS= 12

r/HomeworkHelp - [College Finance] How do you calculate this ... You need to calculate the yield of the bond. N= 54, 30x2 (semi-annual payments) less 3 years of semi annual payments. FV = 1,000. PMT = 40 (This is your coupon 8%/2 * FV) PV = 0.93*1000 = 930. Then cpt the I/Y for the yield on the bond and then double it. Then to calculate the after tax take the yield (1-Tc), where Tc= tax rate.

Solved A General Co. bond has an 8% coupon and pays interest | Chegg.com Question: A General Co. bond has an 8% coupon and pays interest semiannually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 7 years. What is the yield to maturity This problem has been solved! See the answer Show transcribed image text Expert Answer YTM = 40 + (1000-1020.5)/5 … View the full answer

A general co bond has an 8 coupon and pays interest A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in20 years. What is the yield to maturity? A. 7.79 % B. 7.82% C. 8.00% D. 8.04% E. 8.12% B. 7.82 % Yield to maturity is the annual rate of return an investor receives if a bond is held to maturity.

Coupon Rate Calculator | Bond Coupon For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! What is the difference between bond coupon rate and yield to maturity (YTM)?

FINANCE EXAM #2 - CHAPTER 7 Flashcards - Quizlet Interest is paid annually, they have a $1,000 par value, the coupon interest rate is 8%, and the yield to maturity is 9%. What is the bond's current market price? N=10 I/Y=YTM=10 ... A firms bonds have a maturity of 10 years with a $1,000 face value , have an 8% semiannual coupon, are callable in 5 years at $1,050, and currently sell at a price ...

/bond_duration-5bfc37fd46e0fb00260e7d1c.jpg)

Post a Comment for "44 a general co bond has an 8% coupon"