39 a bond's coupon rate

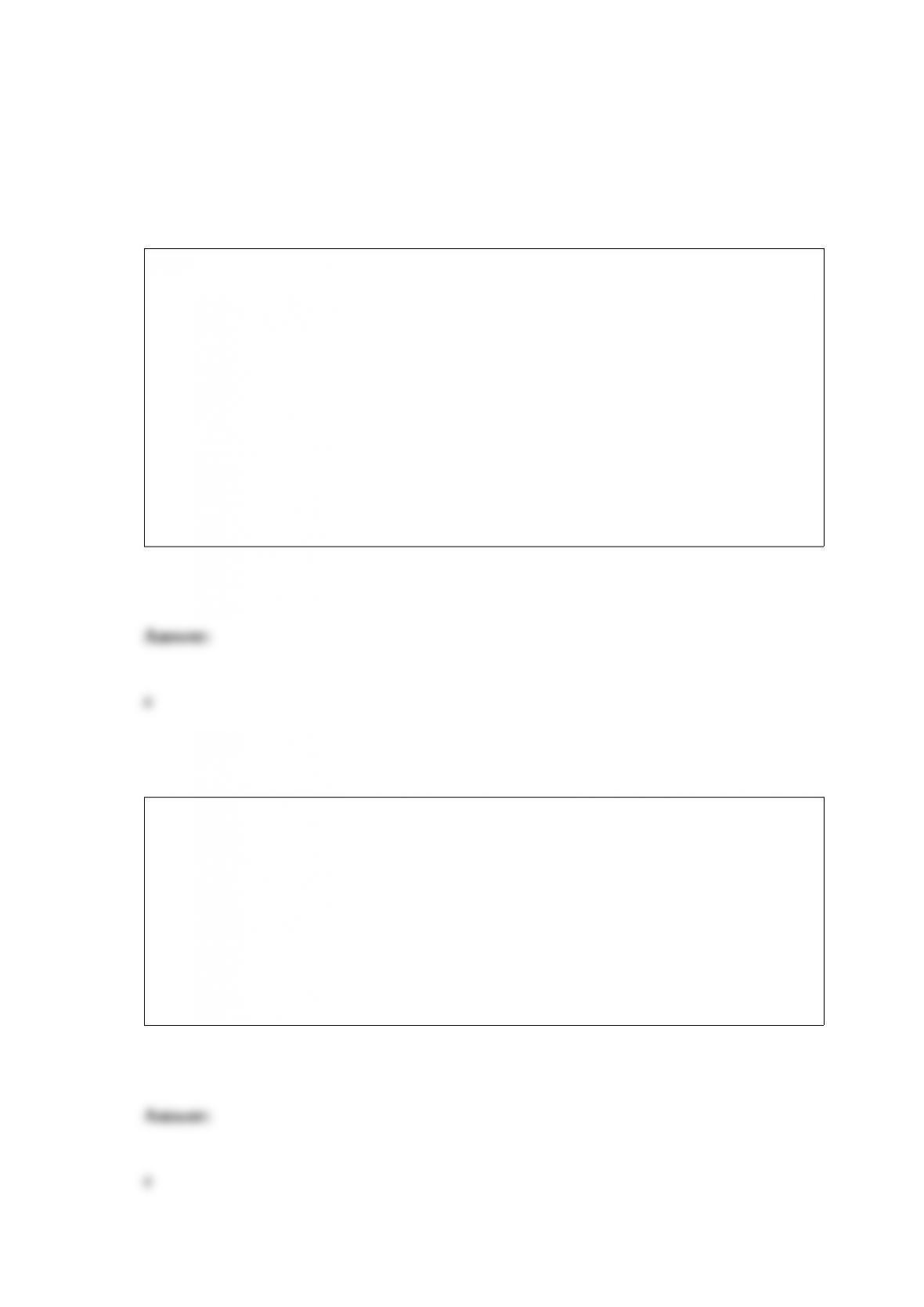

Solved If a bond's coupon rate is 5%, what is the | Chegg.com If a bond's coupon rate is 5%, what is the semi-annual coupon payment? Expert Answer. Who are the experts? Experts are tested by Chegg as specialists in their subject area. We review their content and use your feedback to keep the quality high. Basics Of Bonds - Maturity, Coupons And Yield A bond's coupon is the annual interest rate paid on the issuer's borrowed money, generally paid out semi-annually on individual bonds. The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year, semi-annually.

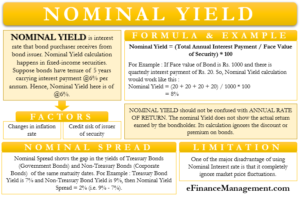

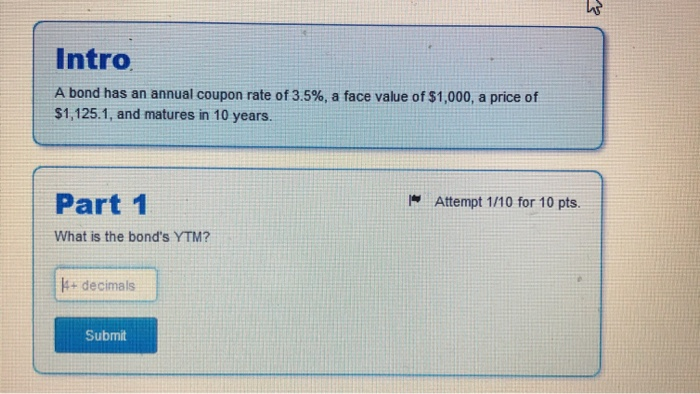

Coupon Rate Definition - investopedia.com The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

A bond's coupon rate

What Is Coupon Rate and How Do You Calculate It? Bond coupon rate dictates the interest income a bond will pay annually. We explain how to calculate this rate, and how it affects bond prices. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford? Mortgage Calculator Rent vs Buy Solved Assume there is a bond with the coupon rate of 12.0 ... Transcribed image text: Assume there is a bond with the coupon rate of 12.0%, yield to maturity (YTM) of 6.2%, and with the face value of $1,000. Further assume that the bond will mature 9 years from now, and that the interest rate will compound semiannually. What is the bond's current market value? O $1,401.25 O $1,399.29 O $1,395.50 O $1,374 ... What Is Coupon Rate of a Bond | The Fixed Income | Bond ... A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment.

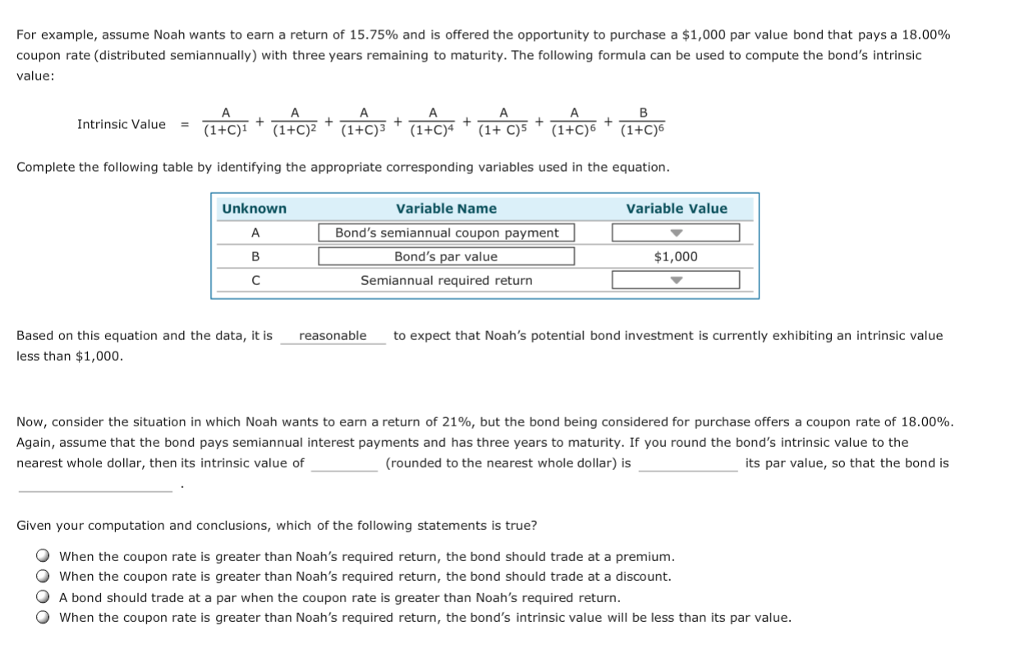

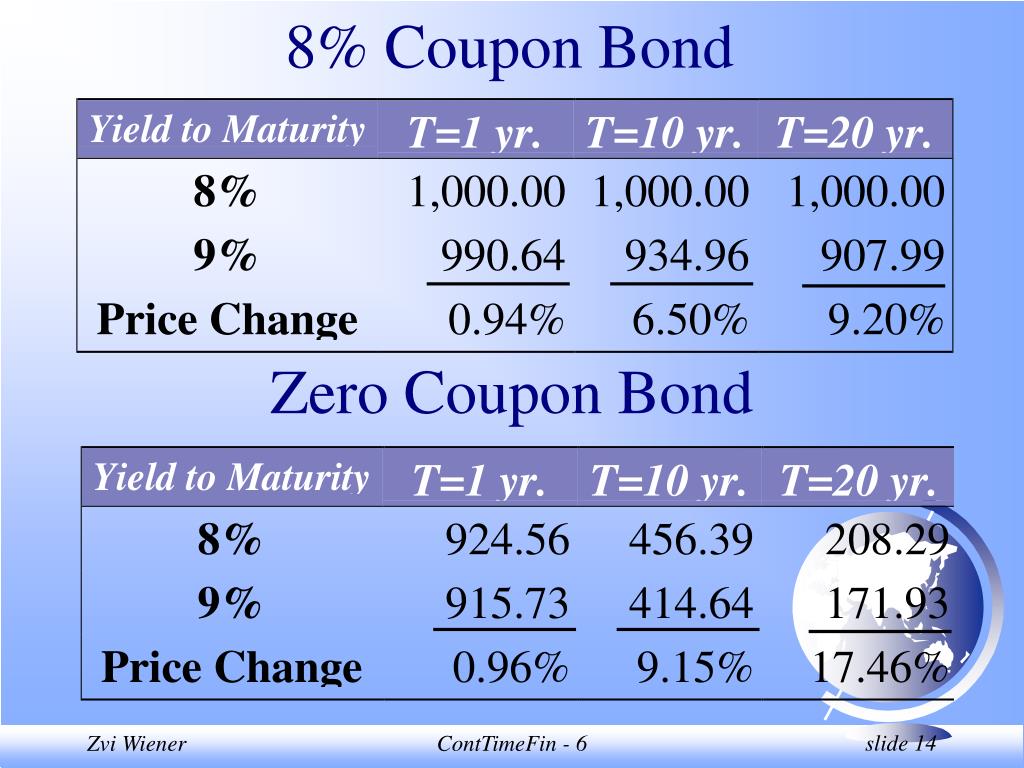

A bond's coupon rate. Coupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Concept 82: Relationships among a Bond's Price, Coupon ... A bond is priced at a discount below par value when the coupon rate is less than the market discount rate. All else equal, the price of a lower-coupon bond is more volatile than the price of a higher-coupon bond. Relationship with maturity. All else equal, generally, the price of a longer-term bond is more volatile than the price of shorter ... Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate. Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

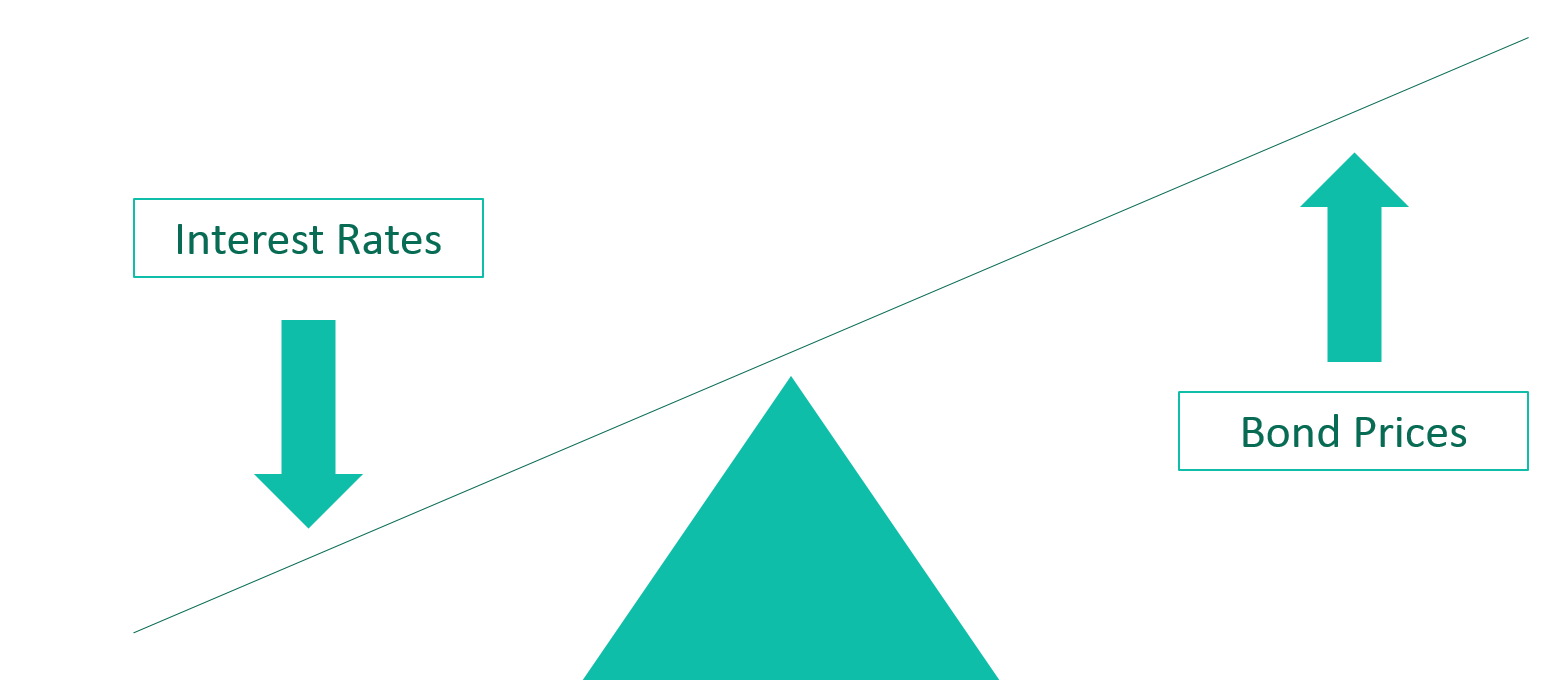

Bond Prices, Rates, and Yields - Fidelity The prevailing interest rate is the same as the bond's coupon rate. The price of the bond is 100, meaning that buyers are willing to pay you the full $20,000 for your bond. 2. Prevailing interest rates rise to 7%. Buyers can get around 7% on new bonds, so they'll only be willing to buy your bond at a discount. Coupon Rate - Meaning, Calculation and Importance To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. What Is a Coupon Rate? How To Calculate Them & What They ... A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. Difference Between Coupon Rate and Required Return (With ... The coupon rate is not calculated on the market value. Instead, it is calculated on the bond's face value. For example, if you have a 5 year Rs 1000 bond that has a coupon rate of 10 per cent, then irrespective of the market value of the bond price, you will receive Rs 100 every year for five years.

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities. Bond Coupon Interest Rate: How It Affects Price A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Coupon Rate Formula | Calculator (Excel Template) Coupon Rate is calculated by dividing Annual Coupon Payment by Face Value of Bond, the result is expressed in percentage form. The formula for Coupon Rate - Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Below are the steps to calculate the Coupon Rate of a bond:

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

What is Coupon Rate? Definition of Coupon Rate, Coupon ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Coupon Bond Formula | How to Calculate the Price of Coupon ... Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd. Therefore, the price of each bond can be calculated using the below formula as,

What is Coupon Equivalent Rate? | IIFL Knowledge Center The coupon equivalent rate is a calculation of the effective yield on a zero-coupon bond. The effective yield is the annual rate of return attached with a period of interest rate, while a zero ...

What Is a Coupon Rate? And How Does It Affects the Price ... Every year it pays the holder $50. To calculate the bond coupon rate, total annual payments need to be divided by the bond's par value. Annual payments = $ 50. Coupon rate = $500 / $1,000 = 0.05. The bond's coupon rate is 5 percent. This is the portion of bond that shall be paid every year.

Coupon Rate Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying the coupon based on the face value of the bond.

Individual - Series I Savings Bonds Rates & Terms ... What have rates been in the past? Our Series I bond rate chart shows in one table all past and current rates--fixed rates, inflation rates, and composite rates.. The two tables below show fixed rates and inflation rates, respectively. Fixed rates. The fixed rate set each May and November applies to all bonds we issue in the six months following the date when we set the rate.

An 8-year corporate bond has a 7% coupon rate. What should ... Bond Price: A bond sells at a premium when its yield to maturity exceeds its coupon rate. When demand for the bond is on the rise, its price increases and it may sell above its face value.

What Is the Coupon Rate of a Bond? A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms . Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest. The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions.)

Answered: The coupon rate is calculated on the… | bartleby B. Other things being equal, an increase in the coupon rate of a bond will decrease its interest rate risk. C. Other things being equal, an increase in a bond's YTM will decrease its interest rate risk. D. Effective duration is calculated as Macaulay duration divided by one plus the bond's yield to maturity.

What Is Coupon Rate of a Bond | The Fixed Income | Bond ... A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment.

Solved Assume there is a bond with the coupon rate of 12.0 ... Transcribed image text: Assume there is a bond with the coupon rate of 12.0%, yield to maturity (YTM) of 6.2%, and with the face value of $1,000. Further assume that the bond will mature 9 years from now, and that the interest rate will compound semiannually. What is the bond's current market value? O $1,401.25 O $1,399.29 O $1,395.50 O $1,374 ...

What Is Coupon Rate and How Do You Calculate It? Bond coupon rate dictates the interest income a bond will pay annually. We explain how to calculate this rate, and how it affects bond prices. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford? Mortgage Calculator Rent vs Buy

Post a Comment for "39 a bond's coupon rate"